DUNNINGTON CLIENT ALERT:

Federal COVID-19 Relief Funding:

What Applicants Need to Know Now to Qualify and Apply

On March 30, 2020, Dunnington provided an alert summarizing various U.S. federal, New York state and municipal economic assistance programs available to individuals and businesses impacted by the COVID-19 pandemic. Two of the federal programs that have been made available via the newly enacted Coronavirus Aid Relief and Economic Security (“CARES”) Act are the Economic Injury Disaster Loan (“EIDL”) including Emergency Economic Injury Grants and the Paycheck Protection Program (the “PPP”). These programs are being implemented quickly, so it is important to understand relevant criteria and application procedures. Below, we provide information concerning these economic relief vehicles. While each applicant’s circumstances may differ, the following serves as a brief guide and checklist to provide information that may be of assistance in preparing to qualify and apply for these federal programs.*

EIDL With Emergency Economic Injury Grants

An EIDL from the Small Business Administration (the “SBA”) has been the traditional source of federal funding for small businesses suffering from economic injury or disaster. The CARES Act now explicitly makes EIDLs available to small businesses and nonprofits impacted by the COVID-19 pandemic. The EIDL carries a maximum maturity of 30 years (depending on the applicant’s ability to repay) and an interest rate of 3.75% for small businesses, and 2.75% for nonprofits.

For businesses that are in immediate need of funding for COVID-19 relief, the CARES Act also implemented the Emergency Economic Injury Grant, which is an emergency cash advance on the EIDL of up to $10,000 for COVID-19 relief. The grant is eligible for loan forgiveness under certain conditions described below.

The following is a general explanation of the criteria and requirements, application procedure, and information and documents needed to qualify for the EIDL, including the Emergency Economic Injury Grant:

Criteria and Requirements

- Loan Amount – Applicant can receive up to $2 million dollars.

- Eligibility – Applicant is eligible if applicant is a small business that meets SBA size standards: sole proprietorship, independent contractor, cooperative or employee-owned business, or tribal small business, that (1) was in business on January 31, 2020, and (2) has 500 or fewer employees. Small business concerns and small agricultural cooperatives that meet applicable SBA size standards are also eligible, in addition to most private nonprofits of any size. (Guidance regarding whether applicant is a “small business” under the SBA’s size standards is available on the SBA’s website here).

- Emergency Grant – The emergency cash advance of up to $10,000 is forgiven if it is spent on paid leave, maintaining payroll, increased costs due to supply chain disruption, mortgage or lease payments or repaying obligations that cannot be met due to revenue loss.

- Overlap with the PPP – Applicants can apply for and receive an EIDL with an emergency cash advance grant and later refinance it into a PPP loan (discussed below), but any emergency cash advance grant received through the EIDL will be subtracted from any amount forgiven under the PPP. Applicants cannot use the EIDL or emergency grant for the same purpose as the PPP

Application

The COVID-19 EIDL application was posted on March 30th on the SBA’s website here. Qualifying applicants will receive a cash advance grant as needed but the full EIDL is issued once the SBA validates an applicant’s information. The form does not require attachments, but applicants will be required to validate their information with the SBA later.

Information and Documentation That Will Be Needed

- Applicant’s six digit North American Industry Classification System (NAICS) code and three year average annual revenue to complete the SBA’s size standard test;

- Records showing the business’s revenue before and after January 31, 2020, dates of formation, and number of employees; and

- Records reflecting the use of the $10,000 emergency cash advance grant (to qualify for loan forgiveness on the advance).

The PPP

The CARES Act has authorized qualified lenders to issue PPP loans to businesses with 500 or fewer employees to pay employee salaries, paid sick or medical leave, health insurance premiums, basic immediate operating expenses like mortgage, and rent and utility payments. PPP loans are eligible for loan forgiveness, and any loan amount not forgiven carries a low interest rate. There are no loan or prepayment fees.

Dunnington previously issued guidance on the criteria for PPP loans. That alert is accessible here.

The following is further information, which has since become available, addressing the requirements, application process, and information and documents needed to qualify and apply for a PPP loan:

Criteria and Requirements

- Good Faith Certification – Applicants must make a good faith certification that the applicant needs the loan to continue operations during the COVID-19 pandemic, will use the funds for applicable covered expenses, does not have any other pending application under the PPP for the same purpose, and has not received duplicative amounts under the PPP from February 15, 2020 until December 31, 2020.

- Qualified Lenders – Banks, savings and loans, credit unions, and other specialized lenders may be qualified as lenders. The Treasury Department is determining additional lenders that will be qualified to issue PPP Ask local lenders whether they will be qualified to issue PPP loans.

- Overlap with EIDL – If an applicant applied for or received an EIDL before applying for a PPP loan, the applicant can also apply for a PPP loan, however, any emergency cash advance received under the EIDL will be deducted from any amount that may be forgiven in the PPP The amount due under the EIDL can be refinanced into a PPP loan. An applicant cannot receive a PPP loan to cover an expense that the EIDL or the cash advance from the EIDL financed. An applicant must make a good faith certification that the application for a PPP loan does not duplicate other loan applications or funding received, including from an EIDL or cash advance under the EIDL.

Application

Sample application forms for the PPP loans were distributed by the Treasury Department on March 31st. Applicants can access the sample application form here. The Treasury Department also released an information sheet accessible here. Please note, however, that qualified lenders are not yet accepting applications for PPP loans. Applicants can review the application form to begin gathering information and documents necessary to submit an application once the PPP loans become available. The anticipated date for applicants to be able to apply for PPP loans is Friday, April 3rd, so consider an EIDL grant if you have an immediate need for funding. Potentially eligible businesses should contact their local lenders as soon as possible to determine whether those lenders are issuing PPP loans, check the SBA and Treasury Department websites daily for instructions and availability, and review any Dunnington updates for information on the application process for PPP loans. Also, begin compiling the documents below and any others an applicant will need to process a PPP loan application.

Information and Documentation That Will Be Needed

- Payroll documentation;

- Any documents needed to fill out the application form for PPP loans; and

- Records reflecting applicant’s use of any PPP loan funding (to qualify for loan forgiveness on qualified uses).

*Fact Based Determination

The foregoing is intended to be helpful information concerning fast-moving and developing guidelines for implementation of newly-enacted legislation. Each application will be unique and decisions will be fact-based, therefore circumstances will vary. Much of the above may be subject to further rule-making and interpretation and therefore, the final loan procedures may vary from the analysis presented above.

Additional Information and Covid-19 Guidance

For assistance about the foregoing, please contact us. We have also assembled resources and alerts for COVID-19-related legal issues and considerations on our website under “News – COVID-19 Guidance.” Please check there for useful information and updates as events evolve.

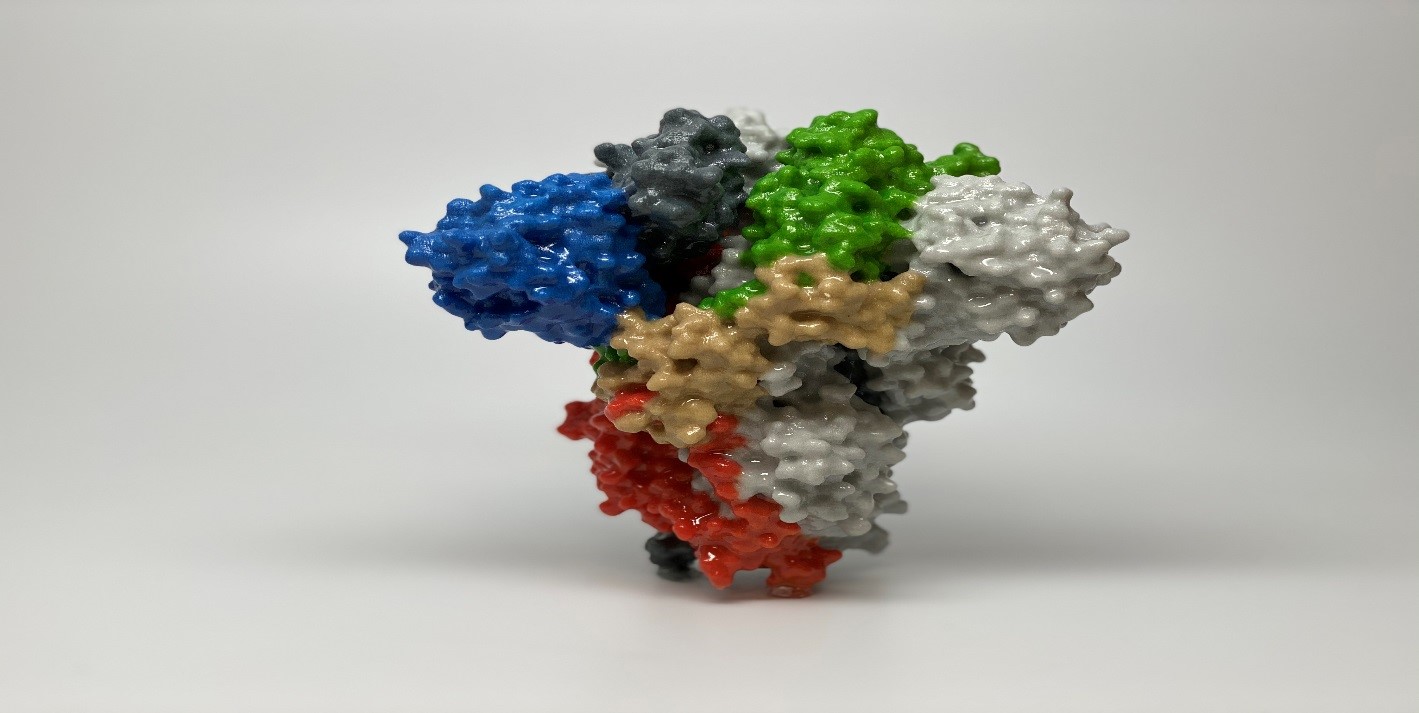

“Novel Coronavirus SARS-CoV-2 Spike Protein” Courtesy: NIAID

*Required Disclaimer: This alert is provided for informational purposes and does not constitute, and should not be considered legal advice. Specific facts and circumstances will differ. Neither the transmission nor the receipt of this information shall create an attorney-client relationship between the transmitter and the recipient. You should not take, or refrain from taking, any action based upon information contained in this alert without consulting legal counsel of your own choosing. Under applicable professional rules of conduct, this informational publication may be considered attorney advertising.