We are pleased to share that Partner Olivera Medenica will be featured in an upcoming issue of Forbes Magazine as part of their “Leaders In Law” series.

We are pleased to share that Partner Olivera Medenica will be featured in an upcoming issue of Forbes Magazine as part of their “Leaders In Law” series.

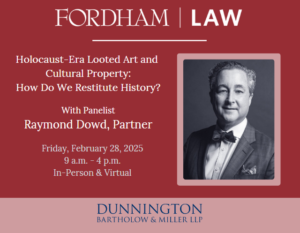

On February 28th, Dunnington, Bartholow & Miller LLP Partner Raymond Dowd will take part in Fordham University School of Law‘s symposium, “Remedies for Looted Art and Cultural Property-Civil, Criminal, or Consensual?” presented by the Fordham Law Review. He will be joined by Christopher McKeogh, Anna B Rubin, and Antonia V. B. for the panel “Holocaust Era Looted Art and Cultural Property: How Do We Restitute History?”, moderated by Judge Hilary Gingold.

On February 28th, Dunnington, Bartholow & Miller LLP Partner Raymond Dowd will take part in Fordham University School of Law‘s symposium, “Remedies for Looted Art and Cultural Property-Civil, Criminal, or Consensual?” presented by the Fordham Law Review. He will be joined by Christopher McKeogh, Anna B Rubin, and Antonia V. B. for the panel “Holocaust Era Looted Art and Cultural Property: How Do We Restitute History?”, moderated by Judge Hilary Gingold.

For more information and to register, click here.

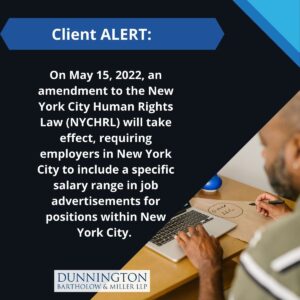

On January 15, 2022, Local Law 32 of 2022 was enacted, which amends the New York City Human Rights Law (NYCHRL) by requiring salary transparency in job advertisements for positions within New York City.

Unless pushed back by the proposed amendment discussed below, starting May 15, 2022, employers advertising a job, promotion, or transfer opportunity in New York City must include a good faith salary range for the position in the advertisement. Specifically, the advertisement must state the minimum and maximum salary that the employer in good faith believes at the time of the posting they are willing to pay for the position (e.g., not “$15 per hour and up” or “maximum $50,000 per year”). If an employer has no flexibility in the salary, the minimum and maximum salary may be identical (e.g., “$20 per hour”). Salary does not include other forms of compensation or benefits offered in connection with the position.

This requirement applies to employers with four or more employees, regardless of whether the employees work from the same location. As long as one employee works in New York City, the employer must comply.

Importantly, this requirement includes job postings seeking full- or part-time employees, interns, and independent contractors. This requirement applies to positions that can or will be performed in whole or in part in New York City, whether from an office, in the field, or remotely from the employee’s home.

Covered listings include postings on internal bulletin boards, internet and newspaper advertisements, and printed flyers. The new law does not prohibit employers from hiring without using an advertisement, and does not require employers to create an advertisement to hire.

Employers who violate this new law may have to pay monetary damages to affected employees and civil penalties of up to $250,000.

On March 23, 2022, the New York City Council introduced an amendment to the salary transparency law that would narrow its reach by, among other things, excluding posts that do not advertise for a specific position. The amendment would also extend the effective date to November 1, 2022. This proposed amendment is pending, and can be found here.

The Dunnington Employment Practice covers all aspects of the employment relationship – from pre-employment matters to post-termination matters.

Required Disclaimer: This alert is provided for informational purposes and does not constitute, and should not be considered legal advice. Specific facts and circumstances will differ. Neither the transmission nor the receipt of this information shall create an attorney-client relationship between the transmitter and the recipient. You should not take, or refrain from taking, any action based upon information contained in this alert without consulting legal counsel of your own choosing. Under applicable professional rules of conduct, this informational publication may be considered attorney advertising.

On January 26, 2022, amendments to New York Labor Law 740 will go into effect, dramatically expanding the scope of protection from retaliation for whistleblowers under New York law. These amendments should have significant impact on employers and employees alike. Read More

Representing first-time homebuyers who had been issued a stop work order and four summonses from the Department of Buildings (“DOB”), Dunnington recently won dismissal of “Class 1” hazardous violations for doing work without a permit, a reduction of thousands of dollars in fines and an order permitting the renovations to proceed. Read More

When a person domiciled outside New York dies owning a home or tangible personal property in New York, a petition to the New York Surrogate’s Court is generally required to gain access to the decedent’s New York situs assets because decedent’s property located in New York at the time of death is ordinarily subject to the jurisdiction of New York’s Surrogate’s Courts. Read More

Authorized by Congress in response to the pandemic, a special tax deduction in 2021 will reward taxpayers who make charitable donations by December 31.

This year only, taxpayers who take the standard deduction can claim an additional deduction of up to $300 for cash contributions to qualifying charities made in 2021. Married couples filing jointly can claim up to $600. Read More

On May 28, 2021, the Equal Employment Opportunity Commission (EEOC) clarified and supplemented its previous guidance from December 2020 relating to vaccination requirements in the workplace. Read More

Susan Rothwell, Partner

February 1, 2021

We’ve made it through the election and a change of administrations. We’re ready for 2021. Big changes to the tax laws may be on the horizon, but, for the moment, estate planning strategies are still governed by the Trump era Tax Cuts and Jobs Act of 2017 (“2017 Act”). Read More

The 5,600 page Consolidated Appropriations Act, 2021 – commonly referred to as the Coronavirus Relief Stimulus Bill that was enacted in late December 2020 – includes three major changes to U.S. intellectual property laws: the Trademark Modernization Act (TM Act), the Copyright Alternative Small-Claims Enforcement Act of 2019 (CASE Act), and the Protecting Lawful Streaming Act (PLSA). The TM Act, CASE Act, and PLS Act contain significant modifications to existing trademark and copyright practices that are summarized below: Read More