Dunnington Bartholow & Miller LLP is pleased to announce that an interview with partner Brenda Gill is featured in the Spring Issue of ‘The Fordham Lawyer.’ Ms. Gill currently serves as the President of the Fordham Law Alumni Association (FLAA) and is the first person of color to hold that title in the FLAA’s 100-year history.

Read the full Q&A here: https://digital.law.fordham.edu/issue/spring-2025/leading-with-purpose/

Dunnington Bartholow & Miller LLP partner Raymond Dowd is featured on a recent episode of the Center for Art Law’s podcast “Art in Brief.” Mr. Dowd sat with Paris Quetzal Sistilli and Andrea Konigs to discuss his work in Nazi-looted art restitution, navigating conflicting international legal systems, and the postwar incentives that fueled the acquisition of stolen art.

Listen here: https://open.spotify.com/episode/2DwCIQgGaOwpZeiT6jdnv1?si=0381d3f21ee34735&nd=1&dlsi=c8e97f57ded2497e

Secondary meaning is a critical concept in trademark law. It enables descriptive or non-descriptive marks to receive protection when consumers associate the mark with a particular source, such as a specific company, rather than just the product or service that it describes. In many instances, a descriptive mark can become powerful source identifier once it has obtained secondary meaning.

Secondary meaning is a critical concept in trademark law. It enables descriptive or non-descriptive marks to receive protection when consumers associate the mark with a particular source, such as a specific company, rather than just the product or service that it describes. In many instances, a descriptive mark can become powerful source identifier once it has obtained secondary meaning.

Under the Lanham Act, trademarks are categorized based on their inherent distinctiveness. This will directly impact their eligibility for protection. There are four broad categories of trademarks: generic, descriptive, suggestive, and arbitrary or fanciful. Generic marks are terms that refer to the general category or class of a product or service. For example, some of these terms include “t-shirts” or “computers.” Generic terms cannot be trademarked because they are common descriptors that must remain available for public use. Descriptive marks are terms that directly communicate details about the product’s ingredients, qualities, or characteristics and can only receive trademark protection if they have gained a secondary meaning that associates them with a particular source. Suggestive Marks suggest a quality or feature of a product but requires a consumer to use their imagination or thought to make the connection. Some examples include “The North Face” and “CITIBANK.” Suggestive marks are inherently distinctive and automatically receive protection under the Lanham Act without proof of secondary meaning. Arbitrary or Fanciful Marks are terms that have no inherent connection to the product or service. For example, “Apple” for computers or “Starbucks” for coffee. These marks are considered inherently distinctive and are eligible for protection without proof of secondary meaning.

The 2025 Art & Fashion Law Conference is two weeks away!

The 2025 Art & Fashion Law Conference is two weeks away!

Sponsored by the Federal Bar Association’s Intellectual Property Law Section and their Southern District of New York Chapter, this year’s conference returns to the offices of Dunnington, Bartholow & Miller LLP in the heart of New York City.

In two weeks, we’ll welcome experts from The Estée Lauder Companies Inc., Louis Vuitton, Ross Stores, Inc., SUPIMA, Model Alliance, Conair LLC, the World Jewish Restitution Organization, and many more. Come ready to network with and learn from top leaders in the Art & Fashion Law industries.

The full program can be found here.

All attendees registered for one or both days are invited to join us for a cocktail hour from 4:30-5:30 p.m. on Wednesday, February 12th. 5 CLE credits will be offered on each day.

Click here to register by Friday, January 31st for a 5% discount!

We are pleased to share that Partner Olivera Medenica will be featured in an upcoming issue of Forbes Magazine as part of their “Leaders In Law” series.

We are pleased to share that Partner Olivera Medenica will be featured in an upcoming issue of Forbes Magazine as part of their “Leaders In Law” series.

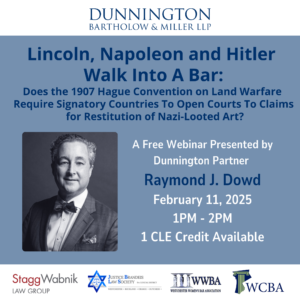

On February 11th, Dunnington, Bartholow & Miller LLP partner Raymond Dowd will present a free online CLE in partnership with the Westchester County Bar Association. One credit in Professional Practice is available. The session is co-sponsored by Stagg Wabnik Law Group LLP, Justice Brandeis Law Society, and the Westchester Women’s Bar Association.

On February 11th, Dunnington, Bartholow & Miller LLP partner Raymond Dowd will present a free online CLE in partnership with the Westchester County Bar Association. One credit in Professional Practice is available. The session is co-sponsored by Stagg Wabnik Law Group LLP, Justice Brandeis Law Society, and the Westchester Women’s Bar Association.

For more information and to register, click here.

On February 28th, Dunnington, Bartholow & Miller LLP Partner Raymond Dowd will take part in Fordham University School of Law‘s symposium, “Remedies for Looted Art and Cultural Property-Civil, Criminal, or Consensual?” presented by the Fordham Law Review. He will be joined by Christopher McKeogh, Anna B Rubin, and Antonia V. B. for the panel “Holocaust Era Looted Art and Cultural Property: How Do We Restitute History?”, moderated by Judge Hilary Gingold.

On February 28th, Dunnington, Bartholow & Miller LLP Partner Raymond Dowd will take part in Fordham University School of Law‘s symposium, “Remedies for Looted Art and Cultural Property-Civil, Criminal, or Consensual?” presented by the Fordham Law Review. He will be joined by Christopher McKeogh, Anna B Rubin, and Antonia V. B. for the panel “Holocaust Era Looted Art and Cultural Property: How Do We Restitute History?”, moderated by Judge Hilary Gingold.

For more information and to register, click here.

A trade dress refers to the total commercial image of a product or its packaging, which may include elements such as size, shape, color, texture, or even packaging style. The distinctiveness of these elements creates a unique visual identity that makes the product easily recognizable in the marketplace. Think of it as the overall “look and feel” of a product that allows consumers to immediately associate the product with a particular company without ever needing to see a logo or brand name.

A trade dress refers to the total commercial image of a product or its packaging, which may include elements such as size, shape, color, texture, or even packaging style. The distinctiveness of these elements creates a unique visual identity that makes the product easily recognizable in the marketplace. Think of it as the overall “look and feel” of a product that allows consumers to immediately associate the product with a particular company without ever needing to see a logo or brand name.

The concept of trade dress is encompassed within the definition of a trademark and is therefore protectable under trademark law. To obtain trade dress protection, your product design or packaging must meet two key requirements: it must be distinctive, and it cannot be functional.

The shape of a glass Coca-Cola bottle for example, is protected by trade dress. The specific blue color that Tiffany & Co’s uses for their gift boxes is also protected by trade dress. As soon as you see the iconic packaging of that little blue box, you think beauty, luxury, and elegance – you think Tiffany’s – even before seeing what is inside. Similarly, as soon as you see the shape of that classic glass Coca-Cola bottle, you think of that classic cola taste (and perhaps childhood memories of a refreshing drink on a hot summer day). That’s trade dress, and it is driven not only by branding but consumer recognition.

For a trade dress to be considered distinctive, it must allow the customer to easily identify the product’s source. When a trade dress is so unique that this identification is clear and immediate, it may be considered inherently distinctive. Otherwise, you must prove that your trade dress has acquired secondary meaning. Secondary meaning is when a trade dress, through extensive commercial use or advertising, becomes associated with a single brand in the minds of the public. For example, the shape of a Ketchup bottle, a Birkin bag, or an iPhone, or even the distinctive configuration of a restaurant. These shapes, colors and designs have all achieved secondary meaning through extensive commercial use and advertising.

The second requirement is that the product’s design cannot be purely functional. Design elements are considered functional if they serve a practical purpose or are essential to the product’s use or effectiveness. For example, a shoe sole pattern that improves traction or a bottle shape that makes the bottle easier to hold. Neither of these elements would be protected under trade dress. Trade dress protection covers the aesthetic elements that make up a product’s signature style and unique branding identity, rather than the product’s functionality.

While trademarks are important for safeguarding your brand’s name and logo, trade dress is essential for protecting the overall look and feel of your products. Both serve as powerful tools in protecting your brand’s identity, reputation and market value.

On February 12 & 13, the Federal Bar Association Intellectual Property Law Section’s 2025 Art & Fashion Law Conference returns to Dunnington Bartholow & Miller LLP. Featuring ten CLE sessions, two keynote speakers and networking opportunities, this two-day conference held in the heart of New York City is a must for those interested in the intersection of art, fashion, and the law. Registration is now open!

On February 12 & 13, the Federal Bar Association Intellectual Property Law Section’s 2025 Art & Fashion Law Conference returns to Dunnington Bartholow & Miller LLP. Featuring ten CLE sessions, two keynote speakers and networking opportunities, this two-day conference held in the heart of New York City is a must for those interested in the intersection of art, fashion, and the law. Registration is now open!

A 10% early bird discount will be automatically applied when you register by January 11th.

Save the Date!

Dunnington’s annual Art & Fashion Law Conference will be held on February 12 & 13, 2025.

Featuring 10 panels across two days, the conference will span a breadth of the latest issues in the art and fashion law sectors, provide networking opportunities, and offer CLE credits for new and experienced attorneys. Registration will open next week.