Please join Gruppo Italiano and Dunnington, Bartholow & Miller LLP Partners William Dahill and Nicola Tegoni on Monday, January 18th at 3:00pm EST for Rebuilding Our Community: PPP Round Two, Work Culture, and Immigration Update… an informative Italian Table Talks Webinar hosted by Gianfranco Sorrentino. Read More

This month we discuss Baby Shark(s), increasing fees, why you shouldn’t lie to the USPTO and more… Read More

On November 19, 2020, the Appellate Division First Department affirmed a decision after trial in which our client was awarded the right to remain, as a rent stabilized tenant, in a luxury Park Avenue apartment which had recently converted to condominium ownership and in which his deceased father’s corporation was the tenant of record. The case was tried by Dunnington Partner Robert N. Swetnick.

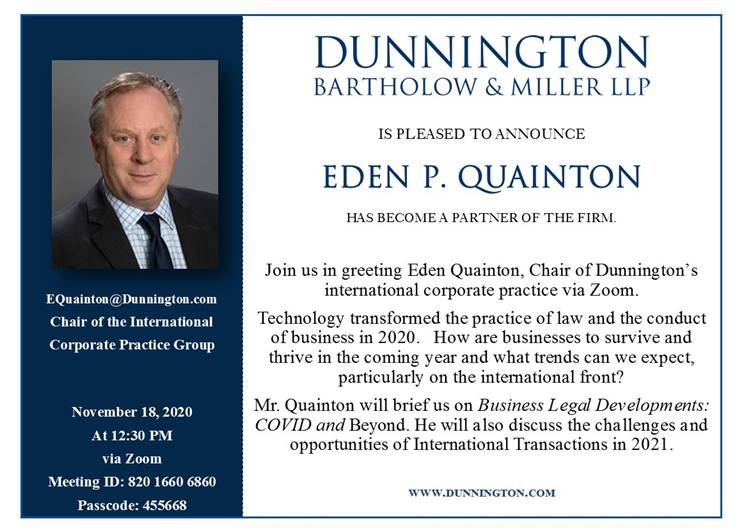

Mr. Quainton is a member of Dunnington’s corporate, international, France and Latin America Desks, litigation/ADR and employment practice areas. Mr. Quainton’s practice focuses on corporate transactions and civil litigation. He speaks French, Spanish, Russian and Italian, and has a working knowledge of German. Read More

In October, the Appellate Division, Second Department unanimously sustained a precedent setting decision obtained by Partner Robert N. Swetnick holding two members of a limited liability company had the right to expel the third member, and that such expulsion did not trigger dissolution of the company. Furthermore, the expelled member did not have the right to receive his pro rata interest in the real estate portfolio of the company, but instead the remaining members could elect to simply purchase his interest.

This month we discuss wine, sweets, ‘Tiffany’ rings … and theft of trademarks? Read More

The Federal Bar Association (FBA) honored Dunnington partner Raymond J. Dowd with its prestigious Earl W. Kintner Award at its 2020 Annual Convention on September 10, 2020. Read More

One of the most important issues entrepreneurs and business owners have to address when forming an entity for their business is fundraising. An entrepreneur that will be raising capital has to make the choice of entity that she believes will be most conducive to that objective. Two entities that are often chosen as the entity for new businesses are limited liability companies (LLCs) and C-Corporations. When it comes to fundraising, there are a variety of factors and questions an entrepreneur must address in deciding which of those entities to choose for the business. We address two of those issues here: (a) the source of the capital and (b) long term goals & exit strategy. Read More

When setting up a company, you must not only choose the right type of entity, but the right state of formation. The term “incorporate” means you are forming a corporation, but a corporation may not necessarily be the best choice for your business (we will address this issue in next week’s post). You may also have heard that Delaware is the premium jurisdiction for your startup. That may be the best choice in some instances, but not always. There are a number of factors to consider when setting up your company, such as how business-friendly the state is, or whether the state is widely recognized as a hub for your venture’s specific industry. Other considerations include proximity to your business, legal jurisprudence favorable to you, and of course, tax implications. Read More

Please join Special Counsel Carolina Pineda on Friday, August 21st at 7:30 EDT to find out what it takes to bring your business into the United States, the different steps required and the alternatives available for your venture. Read More